3 pie charts show dispersion in the US market

This year we have completed some blogs looking at the increase in non-transaction transactions and the dispersion of exchange content, even though the exchange share is still shrinking.

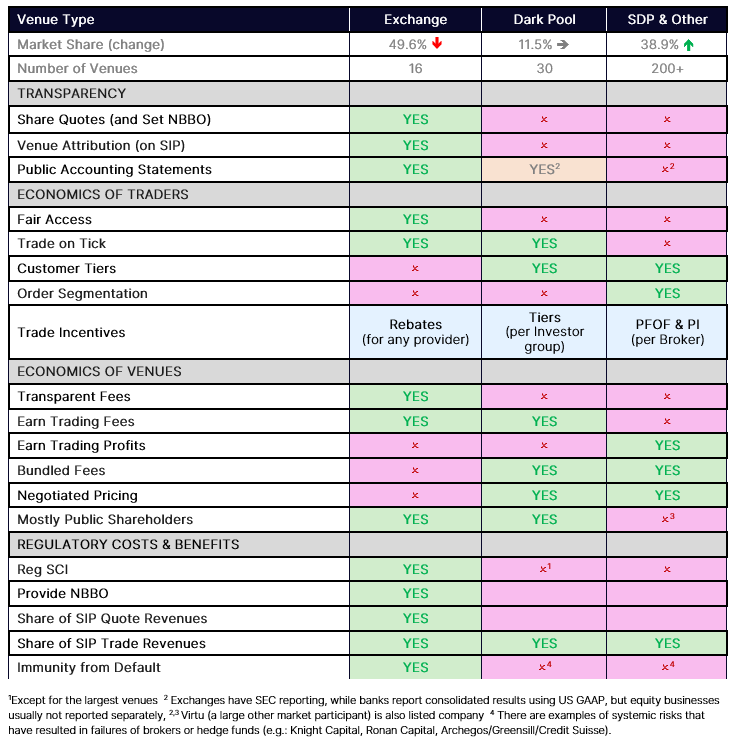

Today, we updated one of our favorite charts that covers order routes, how deals actually complete, and the economic incentives for various parts of the party attracting customers.

You might say that the U.S. stock market is actually more like three interconnected markets, with most retail, mutual funds and arbitrage traders mostly separated from each other – resulting in lower value for each retail, while less price per retail than the number of online.

The US market works more like three separate markets

The following figure shows the latest market share of each pie in the U.S. market structure. These circle sizes are relative to their contribution to the transactions of the entire market. About five years ago, when we first made this chart, we performed 65% of the total market volume on the exchange. As more and more numbers move away from the lighting market, the economics of trading have also changed.

As described below, market rules, trading economics, and how brokers hand over orders, meaning that each pie actually works very differently for the other pie.

Figure 1: Order flow and market share in the U.S. stock market

The rules for each part are very different

The rules and agreements for trading across each of the three sects are also very different.

1. Mainly retail

We say this is “most retail” because it includes various bilaterally agreed deals. This includes a single dealer platform, transactions between other brokers and blocks reached between investors. However, based on work, we (and others) have looked at retail transaction growth, which seems to be the biggest part of the pie, but we admit that this is not the only activity that drives non-exchange growth.

Retail brokers’ orders are usually sent to wholesalers. Since retail orders are small and often random, profit from filling retail value cross-orders is easier than arbitrage differential cross-orders.

As a result, retail is usually filled up before it arrives on the exchange, usually outperforming the restricted orders at a premium price, requiring dark pools and exchanges.

This leads to economic incentives called price increases to make more transactions with this pie. Sometimes, wholesalers also pay for order flows that are particularly profitable with transactions.

2. Black Pool School

Investment banks typically process mutual fund client transactions and build algorithms to cut into large quantities of orders to minimize their impact. They also usually run their own dark pools to keep these customer orders away from communication.

Unlike retail trading methods, the dark pool needs to trade “on the tick” (or often at the midpoint). They do this using NBBO in communication.

This not only helps brokers avoid exchange fees, but also allows them to earn transaction and dietary income.

Furthermore, the ability to segment means that some customers can spread the capture better, which means they are willing to pay higher fees for trade.

However, the nature of both sects is opaque. Instead of setting prices, they use NBBO prices. Additionally, their fees can vary greatly, sometimes transactions are sometimes free or bundled with other services. Even where transactions occur is anonymous (although FINRA does report a lag of 2 to week 4).

3. Exchange stake

Once the liquidity of any of the above-mentioned brokers runs out, the order will fall into the “public” market.

Just like a dark pool, communication requires trading on ticks (or midpoints). However, unlike dark pools, communication is fair to access the market, which means they cannot discriminate against who can trade on their venues or customers based on the profitability of other traders. While things like speed bumps and fees and discounts do affect trading economics, that’s why some places accept orders.

Many experts seem to forget that communication is also important to the entire ecosystem for other reasons. Exchanges publish the best prices and then use them throughout the industry to protect investors from bad filling. Some also list and provide the services required for public companies that want to enter the public market.

Table 1: The trading rules of each stake are very different

There is a very fragmented, segmented market in the United States

The data shows that not only is the US stock market very fragmented, but it is also segmented when orders arrive.

This affects the economics that provide “positive externalities”, such as bringing more IPOs to the market and providing prices to protect investors. It transfers the economics of trade and dissemination capture from those who offer NBBO to those who trade first in segmented venues. It reduces the actual mobility that everyone can use. Retail and institutional investors also have difficulty trading directly with each other.

The US market structure is not only complex. It is far from a level playing field.