Zeta Global stock price will beat peers to rise 125% in 2024: specific data – Freshworks (NASDAQ: FRSH), Temenos (OTC: TMSNY)

Zeta Global Holdings Inc. ZetaA marketing technology company focused on artificial intelligence-powered marketing solutions will outperform the NYSE Composite Index in 2024, while its peers lag the market. Based on fundamental and technical analysis, should you buy, sell, or hold this stock? Here’s what analysts have to say.

As of Thursday’s close, Zeta shares were up 1.23% at $18.97 per share. The stock is up 125.83% this year, outperforming the NYSE Composite, which is up 14.98%.

His peers, fresh factory inc. FRSH dropped by 27.26%, Temenos ADR TMS New York It fell 21.52% over the same period.

Daily moving average technical analysis shows a bearish short-term trend.

The stock closed Thursday at $18.97 per share. This is below the 8-day and 50-day simple moving averages of $19.52 and $21.69 respectively. However, shares are also currently below its 50-day moving average of $24.42 and its 200-day moving average of $24.42, according to Benzinga Pro.

This means the stock is in a downtrend. On the other hand, a RSI of 38.38 suggests the stock is moderately oversold but still in neutral territory.

See Also: NVDA Could Rise to $170 in Q1 After Breaking Above $145 Levels as Traders Become Bullish on Jen-Hsun Huang’s Artificial Intelligence Giant

Two Zeta customers merge

Zeta Global will benefit from Omnicom’s acquisition of Interpublic. David A. Steinberg“We are proud of our extensive relationships with top holding companies, including Omnicom and IPG, and believe today’s announcement is a positive one,” Zeta co-founder, chairman and CEO said in a December 9 statement. News for Industry and Zeta. Like everyone else, we will monitor the situation closely and provide support as needed.

Zeta said at the investor summit that it can leverage the combined entity’s vast data infrastructure and enhanced financial strength. This provides Zeta with the opportunity to deepen AI-driven customer insights, expand scale and reach, and accelerate growth.

Zeta’s new acquisitions

Zeta Global’s acquisition of LiveIntent is expected to contribute “vast data assets, direct pipeline capabilities and a network of premium publishers to the Zeta marketing platform. Integrating LiveIntent into ZMP will expand gross margins while accelerating our revenue from agency clients to Steinberg’s 2024-10 The statement on March 8th added.

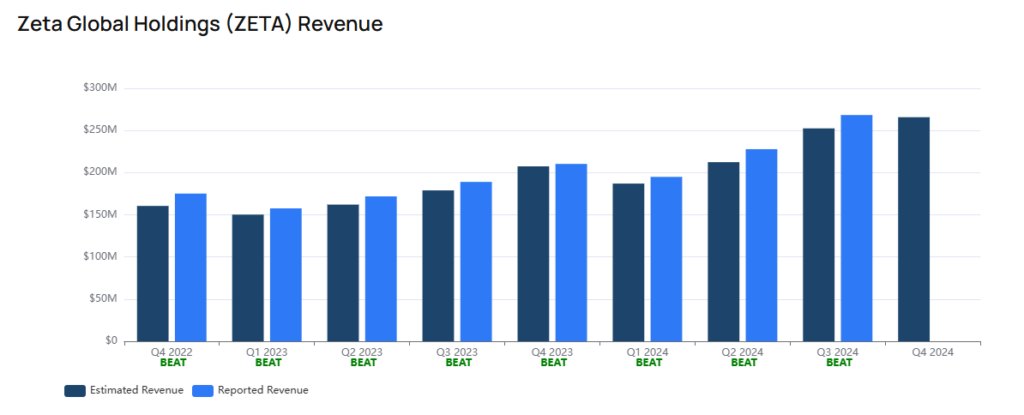

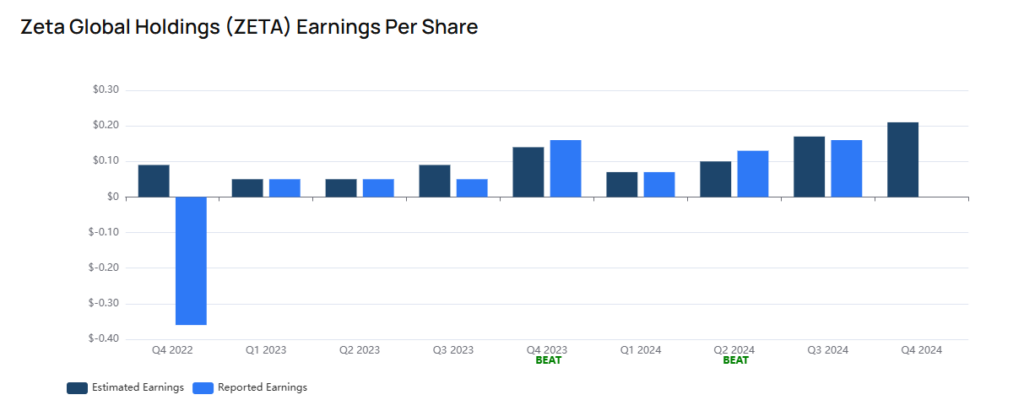

ZETA’s estimated top and bottom lines

Benzinga expects fourth-quarter revenue to be $265.73 million, an increase of 26.34% from revenue of $210.32 in the same period last year.

The consensus estimate for fourth-quarter earnings is 21 cents per share, compared with 16 cents per share in the same quarter last fiscal year, which actually represents growth of 31.25% from the prior year.

Zeta has higher liquidity to meet obligations

As of the end of the third quarter, the company’s current ratio was 3.319, beating its industry average of 2.16, according to Benzinga Pro. The ratio surged 67.7% from the previous quarter, indicating its strong ability to meet short-term obligations.

See also: Should you buy or sell this Nvidia rival? Analysts weigh in, technicals point to downtrend

What analysts say: According to Benzinga, Zeta has a consensus rating of “Hold” based on 17 analyst ratings, with a price target of $32.59.

Among all analysts tracked by Benzinga, the highest target price is $45 issued by Craig-Hallum on November 12, 2024, with a “buy” rating. Jason Krell Underscoring Zeta Global’s strong performance, driven by the successful acquisition of LiveIntent and cross-selling opportunities. Analysts are positive about deepening penetration of the existing $100 billion-plus customer base by replicating successful high-spending customer relationships.

Goldman Sachs Analyst Gabriella Borges Initially gave Zeta a “neutral” rating and announced a $30 per share price target. The note highlights key medium-term risks. As data accessibility and consumer preferences continue to change, the value of its proprietary data may be eroded, requiring continued innovation. Strong performance in 2024, driven in part by one-time events, could make year-over-year comparisons in 2025 challenging. It shows poor performance in recent industry reviews.

Credit Suisse maintained “neutral” and the lowest target price was adjusted from $12 per share to $9.5 on August 4, 2022. is 105.13%.

Read next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. all rights reserved.