How to watch Games Done Quick's Frost Fatales speedrunning event from March 9

Games Done Quick’s next weeklong charity speedrunning shindig kicks off this weekend. Frost Fatales, one of GDQ’s two events celebrating women and femmes, runs from March 9 to 16, raising money for the nonprofit National Women’s Law Center.

Frost Fatales is the winter installment of the pair of events organized by GDQ’s Frame Fatales speedrunning community. (Its summer counterpart is Flame Fatales.) Last year’s Frost Fatales raised $155,000 for the same nonprofit, which fights for gender justice in issues central to the lives of women and girls. Since the first Frame Fatales event in 2019, the biannual speedruns have raised over $1 million for charity.

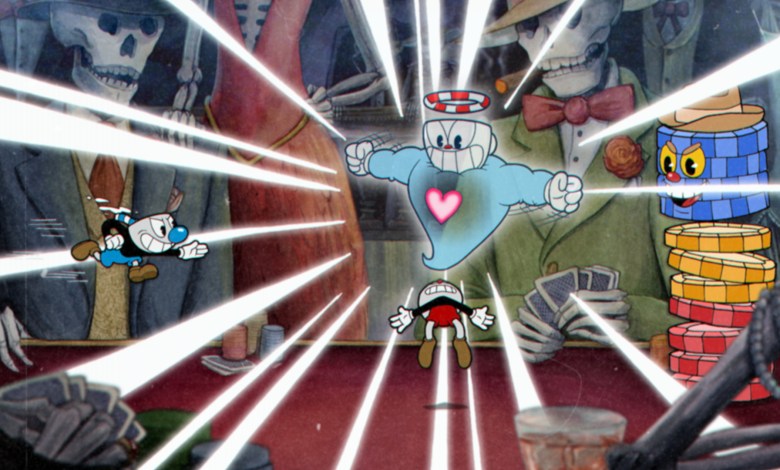

This year’s festivities dive right into the deep end with a run of the charmingly punishing Cuphead at 1PM ET on Sunday, followed by Super Mario Odyssey a mere hour later. Anyone who can beat Cuphead in that time deserves a Medal of Honor.

Other notable runs from the week include the OG Legend of Zelda on Sunday, the Wii reboot of Punch-Out!! on Monday, a “girl squad” three-way race in Final Fantasy X-2 on Wednesday and a race to defeat Ganon (again) in Breath of the Wild on Saturday. The week wraps up with a one-handed (say what?) speedrun of the indie platforming classic Celeste later that night.

You can check out GDQ’s schedule for the full lineup of games. The weeklong event streams exclusively on the GDQ Twitch channel (also embedded below), starting with that must-see Cuphead run at 1PM ET on Sunday.

This article originally appeared on Engadget at