The bank transfer alert text you receive may be a scam

We recently received an email from Jane who wrote us a suspicious text message about the one she received.

Her experience is a key reminder for all of us to remain alert when facing these evolving digital threats.

Let’s dig into Jane’s encounter and explore what 2025 means for our financial security.

Stay safe and know – free! Subscribe to Kurt’s “Network Gu” report for free security alerts and technical tips

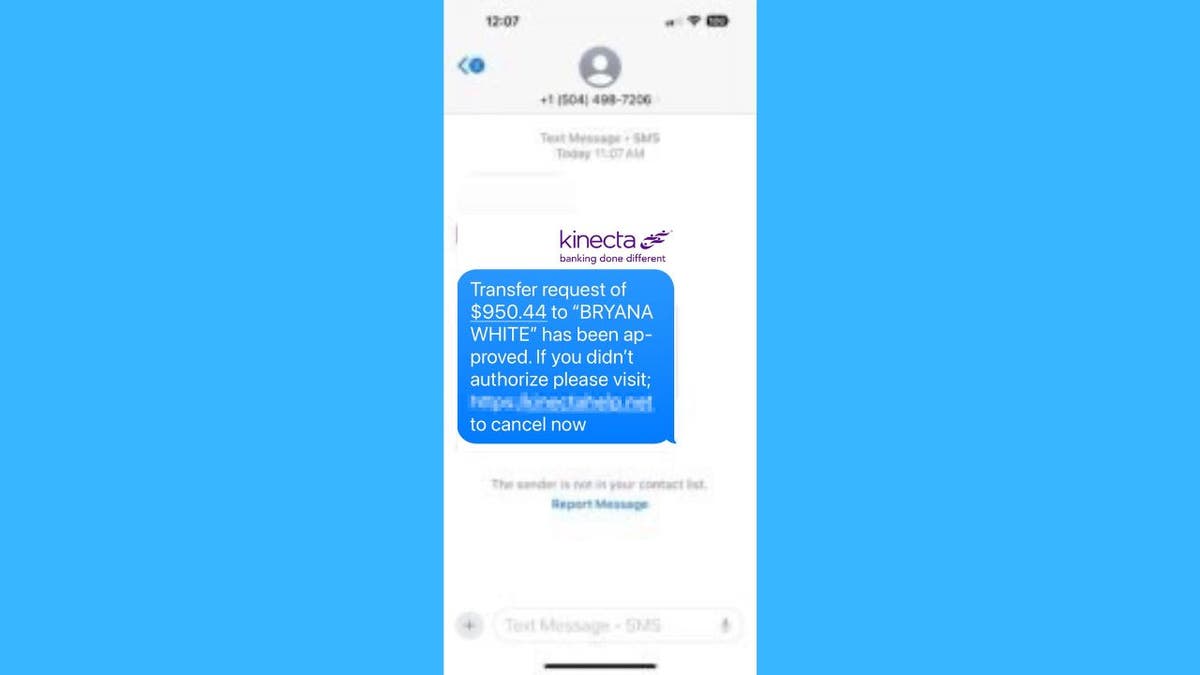

People who receive the transfer alert scam text (Kurt “Cyberguy” Knutsson)

Jane’s Shocking Text: A Textbook Scam Trial

Jane wrote us the following questions:

“I just received a text from Kinecta, California that said: ‘The transfer request for $950.44 transferred to Bryana White has been approved. If you do not authorize, please visit (link here) to cancel immediately.’ Is this a scam?

Very good question, Jane! Your caution is commendable, and yes, you should worry. Let’s break down this scam attempt and see why it adds so many red flags.

Kinecta scam text (Kurt “Cyberguy” Knutsson)

Best Antivirus Software for Mac, PC, iPhone and Android – Web Choice

Red flag: Scam found

Jane’s text message showed several obvious signs of a scam that everyone should be aware of:

Urgent as a weapon: Scammers use our fear of economic losses to prompt hasty action. They use phrases like “act now” or “cancel now” and warn of the dire consequences if they don’t act immediately. This urgency is designed to bypass reasonable thinking and prevent you from verifying the legitimacy of the request.

Suspicious links: Legal banks avoid sending security-sensitive links through text. These links can download viruses to your device or take you to fake websites designed to steal your personal information. Be sure to verify the URL before entering any sensitive data.

Specific but unfamiliar details: It’s a clever strategy to mention “Bryana White” and the exact amount of $950.44. Even if these details are unfamiliar with the receiver, the scammers often use specific details to create fantasies of legitimacy. This approach aims to instill suspicion and urgency, increasing the chances of victims to act quickly.

What is artificial intelligence (AI)?

Brand imitation: Scammers often adopts brand imitation strategies, using similar logos, fonts, and color schemes to create legitimacy looks. This deceptive strategy is designed to manipulate you believe you are interacting with trustworthy institutions, increasing the likelihood that the scammers will be in trouble.

Unsolicited Contact: Be wary of unexpected texts claiming to be from the bank, especially if you have not registered for text alerts.

Spelling and grammar errors: Looking for spelling, grammar, or punctuation errors. Legal information from banks is usually written by professionals and is free of errors.

Request personal information: Scammers often ask you to “confirm” details like your account number or password. Legal banks never request sensitive information through text.

Too good to be a real offer: Suspected of hopeful huge returns or unexpected information.

Stress strategy: Scammers often use threatening language or imposing pressing deadlines to manipulate you to act quickly without thinking.

The person who received the scam text (Kurt “Cyberguy” Knutsson)

How to fight back with debit card hackers who follow your money

The script of the cheater: The goal is revealed

These number cheaters have 3 clear goals:

- Data theft: Attract you to fake websites to earn a login certificate.

- Malware Distribution: Scare you to download malware.

- Financial fraud: Manipulate you to reveal sensitive financial information.

Illustration of a liar at work (Kurt “Cyberguy” Knutsson)

9 Ways of Scammers Using Your Phone Numbers to Try to Scam You

How to protect yourself from text scams

As scammers become more complex, it is crucial to arm your knowledge and take positive steps to protect your personal information. Here are seven basic tips to help you stay protected:

1. Never click suspicious links in text messages: In Jane’s case, clicking on the link could have resulted in a fake Kinecta website designed to steal her login certificate.

2. With powerful antivirus software: This can help detect and block malware and may be downloaded if Jane clicks on the scammer’s link. The best way to protect yourself from installing malware (malicious links that may access private information) is to install antivirus software on all devices. This protection can also remind you about phishing email and ransomware scams, ensuring your personal information and digital assets are secure. Offer the best 2025 antivirus protection winners for your Windows, Mac, Android and iOS devices.

Click here to visit Fox Business

3. Use the official channels to contact your bank directly: Jane should call Kinecta’s official number to verify that there are any real problems with her account, rather than replying to the text.

4. Report the text to your bank and forward it to 7726 (spam): By reporting this article, Jane can help Kinecta and her mobile operators protect other customers from similar scams.

5. Enable two-factor authentication (2FA) On your account: This extra layer of security also prevents scammers from accessing Jane’s account even if they get a password.

6. Use the SMS filtering tool provided by mobile operators: These tools may have captured and marked suspicious “kinect” text before reaching Jane’s inbox.

7. Invest in personal data deletion services: This can help reduce the amount of personal information available online, making it harder for scammers to target Jane and your personalized attacks on you. While there is no service that promises to remove all data from the Internet, it is great to have a deletion service if you want to keep monitoring and automatically delete information from hundreds of sites. Check out my preferred data deletion service here.

Kurt’s key points

Remember that a legitimate financial institution will never force you to act immediately or click on a link in a text message. If you have any questions, please always use the official channel to contact your bank directly. Thank you Jane for getting our attention. Your vigilance not only protects you, but also helps others educate. Together we can lead the liar and protect our financial situation one step ahead.

Click here to get the Fox News app

What steps do you think governments, FCCs or cellular providers, should the statutory bodies take to stop the rise of scam texts and protect consumers from these malicious programs? Let’s write to us cyberguy.com/contact

For more technical tips and security alerts for me, please subscribe to my free online reporting newsletter cyberguy.com/newsletter

Ask Kurt a question or let us know what stories you want us to cover

Follow Kurt on his social channels

Answer the most questioned online gu questions:

New things from Kurt:

Copyright 2025 CyberGuy.com. all rights reserved.