World News

Search continues for thousands of missing Palestinians in Gaza

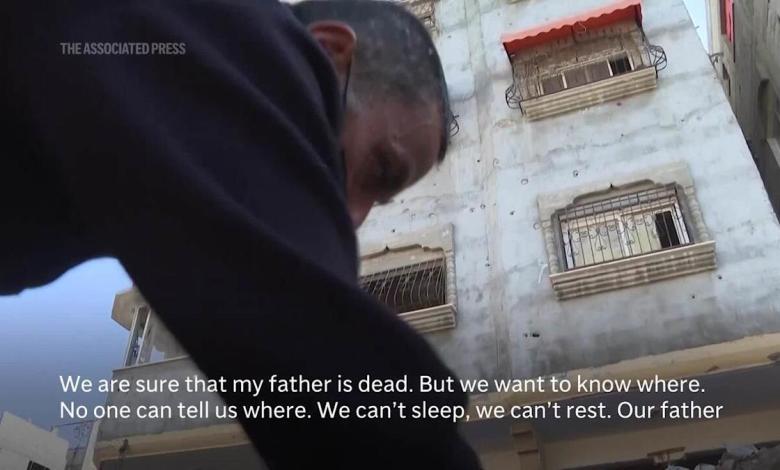

Reem Ajour said she last saw her husband and their then-4-year-old daughter in March, when Israeli soldiers attacked a home in northern Gaza. She has been haunted by those chaotic final moments when soldiers ordered her to leave, leaving Talal and Massa behind, both injured. Their cases are just a few of the thousands of people missing during the 14-month war. (AP video by Abed Al-Kareem Hana and Mohammad Jahjouh/Wafaa Shurafa)