European exceptionalism? |Nasdaq

After 2 years of American exceptionalism, European stock +10% ytd vs. +4% US

The story of global stocks has been one of the “American exceptionalism” over the past few years, where U.S. stocks are largely outperforming other markets due to the U.S. (and Nasdaq-listed) MAG 7.

U.S. stocks receive +59% in 2023 and above – over Double European gain +24% (both measured by Msciindices for large and medium covers).

However, starting from 2025, the United States is not that great.

In fact, Europe doubled the US, with MSCI Europe rising +10% (chart below, gold line), while the US was +4% (blue line).

Europe’s leading edge is based on numerous

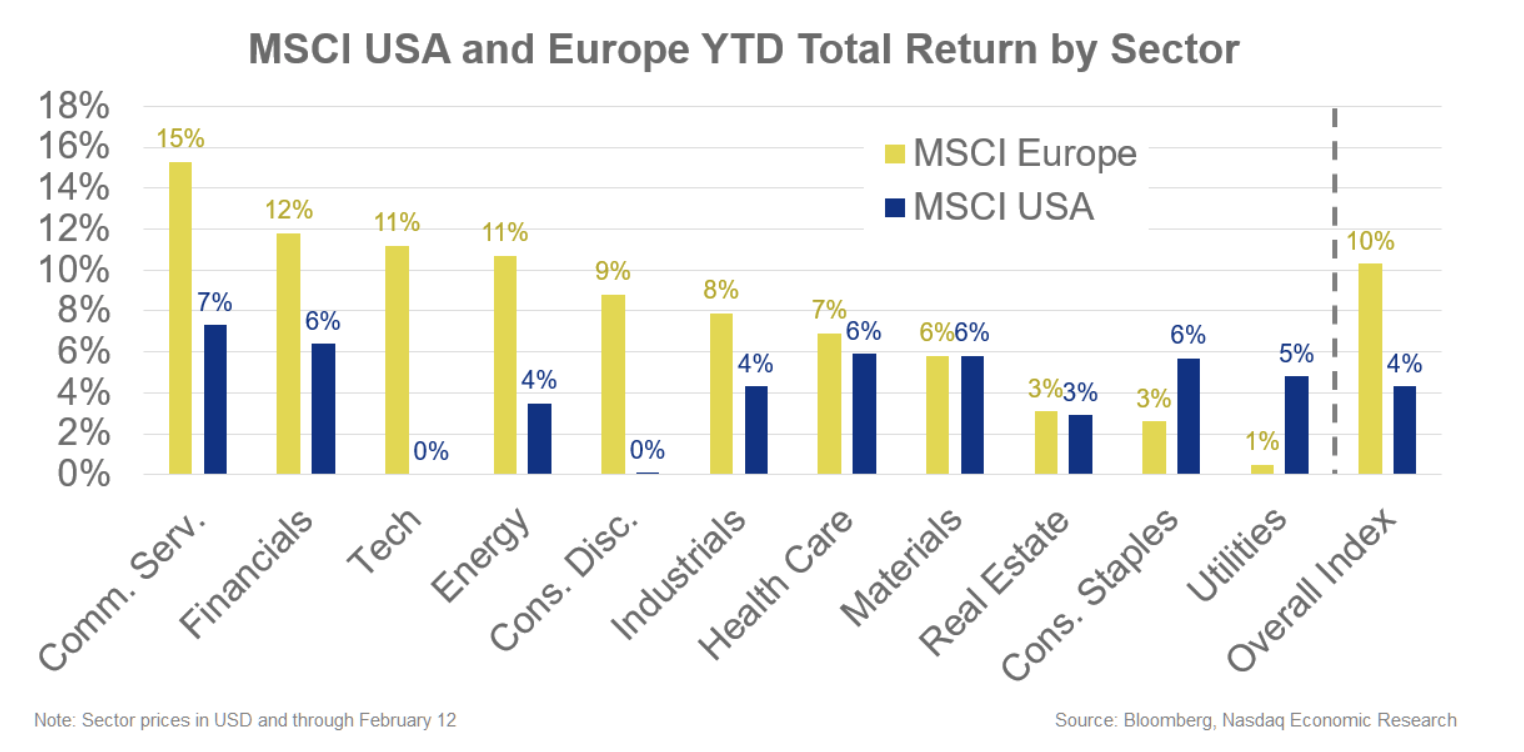

It’s not just one thing to drive it. If we look at the earnings this year (picture below), Europe (Gold Bars) beat the United States (Blue Bars) in 7 of 11 industries, and they are essentially two (Materials and Real Estate).

Therefore, European leadership is broad.

Artificial intelligence exposure, higher rates and “expensive” valuations are bigger for us

There are several different reasons why the United States lags behind Europe:

- We’re more exposed to artificial intelligence. Technology accounts for 40% of MSCI in the United States, while Europe is only 10%. This has been good for the U.S. over the past two years, with AI optimism helping MAG 7 grow +156%. But the MAG 7 is flat this year, partly because of DeepSeek’s low-cost, high-performance model that alleviates AI optimism (and Big Tech’s plan to plan $30 billion in spending on AI this year). However, Europe is more inclined to finance, healthcare and industry.

- With Europe’s cuts, the United States faces higher speeds. The market has only priced 40bps in this year’s Fed cuts, while the 120bps from the European Central Bank (including the 25bps cuts they have made). Therefore, it is expected that the European economy will decrease from the rate of decline.

- Europe is “cheaper” relative to us. The U.S. price/income valuation ratio is above 22, approaching record highs during Covid and Dotcom Bubble – while Europe’s PE just exceeded 14 – close to its 20-year average, about two-thirds of U.S. PE . Therefore, European stocks are relatively “cheap” compared to the United States. Additionally, higher interest rates (#2) make it more difficult to maintain high PES, as higher borrowing costs make future incomes more difficult to achieve.

- Europe’s income recession. After seeing a -2% decline in revenue in 2024, MSCI Europe is expected to rise +7% this year. Although this will result in an estimated +13% earnings in the U.S.

Nevertheless, most of these factors are already in place besides the optimistic scheduling of AI.

So, this is more of a story of slowing down than the U.S. story of recovery from Europe (after getting +2% last year). After all, MSCI USA just fell below its all-time high (January), and earnings +4.3% in six weeks is not bad.

The information contained above is for informational and educational purposes only and nothing in this article should be interpreted as investment advice on a specific security or overall investment strategy. Neither Nasdaq, Inc., nor any of its affiliates makes any suggestions for purchasing or selling the financial status of any company. Statements regarding NASDAQ listed companies or NASDAQ Proprietary Indexes do not guarantee future performance. Actual results may differ materially from those expressed or implied. Past performance does not represent future results. Investors should conduct their own due diligence and carefully evaluate the company before investing. It is highly recommended to provide advice from securities professionals. ©2024. Nasdaq, Inc. All rights reserved.