Small earthquakes in Santa Monica Bay can cause coasts to shake weakly

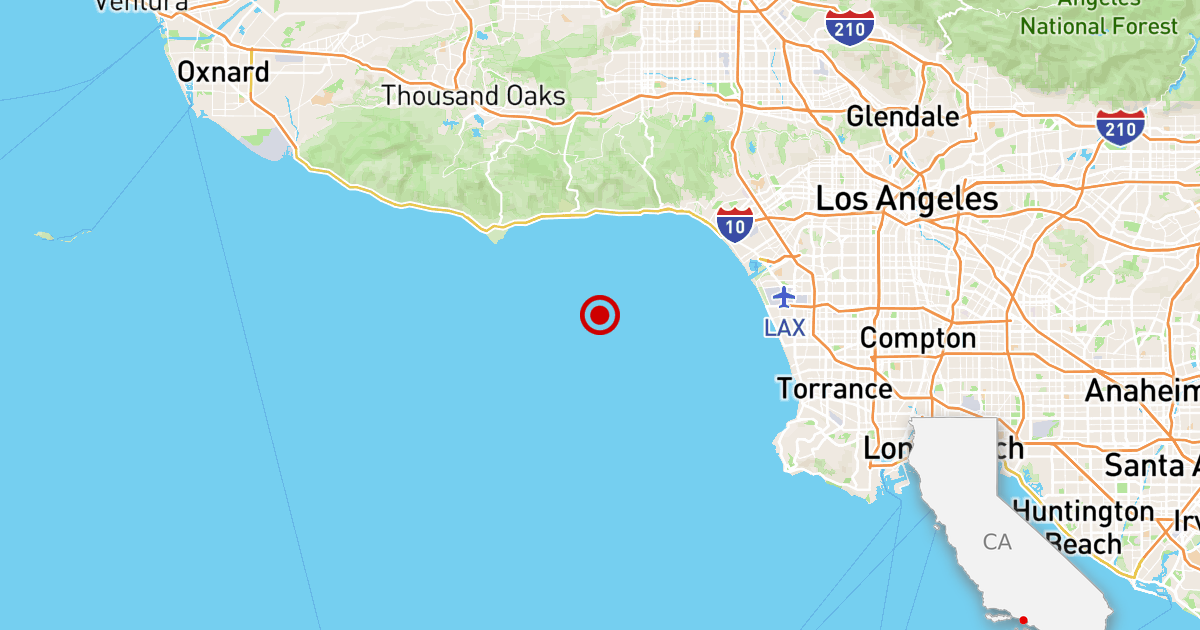

According to the U.S. Geological Survey, a magnitude 2.7 earthquake was reported in the Pacific Ocean at 7:48 p.m. Sunday.

The earthquake was also about seven miles from Malibu and Santa Monica, nine miles from Topanga and nine miles from El Segundo.

USGS said some reports have been shaking weakly along the Santa Monica Bay coastline.

There have been five earthquakes of magnitude 3.0 or greater nearby in the past 10 days.

According to the last three-year data sample, the Greater Los Angeles area has an average of 59 earthquakes per year, with 2.0 to 3.0 earthquakes per year.

The earthquake occurred at a depth of 6.9 miles.

Do you think this earthquake has occurred? Consider reporting your feelings to USGS.

When are you ready to hit the big guy? Prepare for the next big earthquake by signing up for our Unshape Newsletter, which breaks the emergency down into six weeks of bite-sized steps. Learn more about the applications you need and the ones you need at latimes.com/unshake.

This story is automatically generated by Quakebot, a computer application that monitors the latest earthquakes detected by USGS. The editor of Time reviewed the post before it was released. If you are interested in learning more about this system, please visit our list of FAQs.