New York court appoints new judge to handle Trump civil fraud case arising from Attorney General Letitia James’ investigation

First up is Fox: A New York court has assigned a new judge to preside over New York Attorney General Letitia James’ civil fraud case against President-elect Trump.

The case and trial are being presided over by Judge Arthur Ngoren, who Trump allies accuse of being biased against the president-elect, his family and the company.

Appeals court rules cut Trump’s $454 million sentencing bail by more than half

Sources familiar with the move told Fox News Digital that the court has assigned New York County Supreme Court Staten Island Judge Judith McMahon to the case.

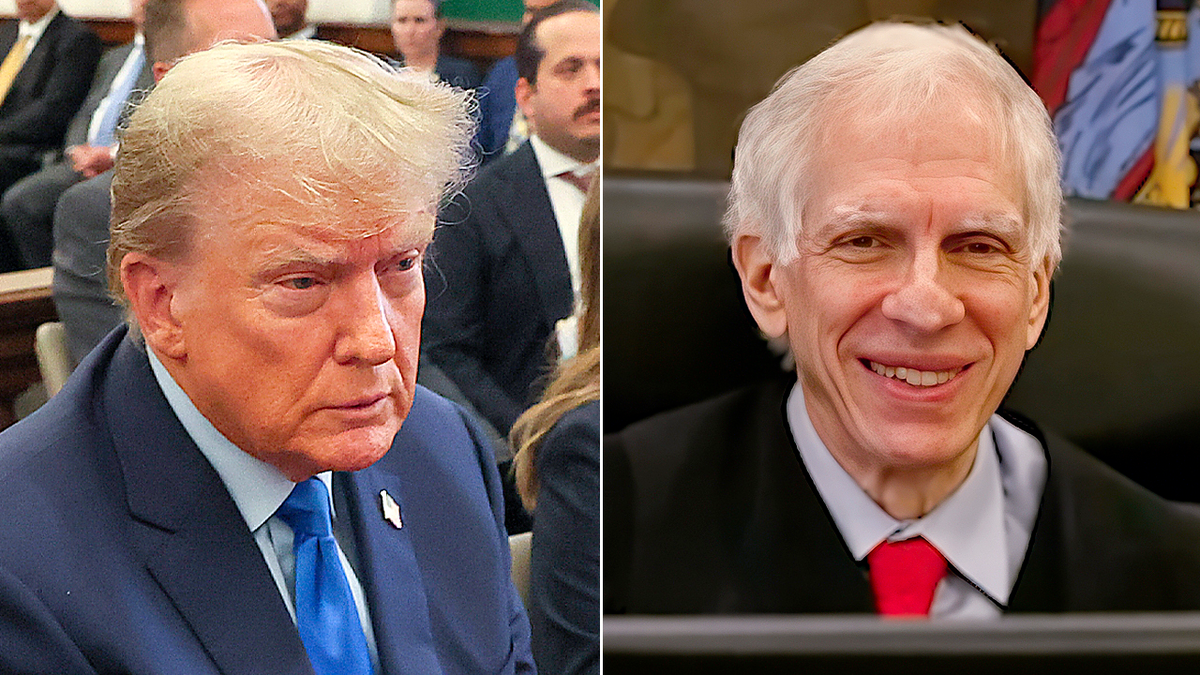

On November 13, 2023, Judge Arthur Engoron presided over the Trump Organization’s civil fraud trial in the New York State Supreme Court in New York City. (ERIN SCHAFF/POOL/AFP via Getty Images)

The case is currently pending appeal. After the appeals court rules, the case will be sent back to the lower court for a new trial, with Ngorong presiding over it.

Sources said McMahon will take over for further proceedings once the appeals court rules.

New York appeals court appears willing to throw out or reduce $454 million Trump civil fraud verdict

Ngolon’s weeks-long nonjury civil fraud trial began in October 2023, and last year found Trump and the defendants guilty of “persistent and repeated fraud,” “falsifying business records,” “issuing false financial statements,” “Conspiracy to falsify financial statements,” “Conspiracy to commit insurance fraud,” and “Conspiracy to commit insurance fraud.”

President-elect Donald Trump (left) and New York Judge Arthur Ngoren (Fox News)

But before the trial could begin, Ngolon issued a summary judgment against Trump, making the ensuing trial a case about the fines that should be paid.

It is worth noting that in this case, Ngolon allowed Trump’s Mar-a-Lago to be listed for $18 million. President Trump disputed the valuation, saying the property was worth 50 to 100 times Ngolon’s estimate. Real estate insiders and developers believe the property could be priced at more than $300 million.

In ruling on the case last year, Ngolon lashed out at Trump, criticizing his participation in the trial, saying he “rarely answered the questions posed and often inserted lengthy, lengthy statements about matters that went far beyond the facts.” Irrelevant speech”. Scope of trial. ”

Former President Donald Trump’s Mar-a-Lago resort in Palm Beach, Florida. (Charles Trainor Jr./Miami Herald/Tribune News Service via Getty Images)

Eric Trump denounces New York ‘conspiracy’: My father built the New York skyline and this is his thanks

“His refusal to answer questions directly, or in some cases at all, severely damaged his credibility,” Ngolon wrote.

During the trial late last year, Trump, Trump allies, Republicans and legal experts repeatedly criticized Ngolon – who has been a vocal critic throughout his career. Donate specifically to the Democratic Party — about his handling of the case.

New York State Attorney General Letitia James speaks at a press conference in New York on September 21, 2022. (AP Photo/Britney Newman, File)

Ngolon is also reportedly under investigation for receiving unsolicited advice about the case.

Trump and his family deny any wrongdoing, and the former president says his assets are undervalued. Trump’s legal team insists his financial statements have disclaimers and made it clear to banks that they should conduct their own evaluations.

Trump vows to fight “all the way to the U.S. Supreme Court” as the deadline to recover $454 million is approaching

Trump appealed the $454 million verdict. The appeal is pending before the New York Court of Appeals.

New York appeals court judges last year appeared to accept the possibility of vacating or reducing the verdict. $454 million civil fraud judge.

President-elect Donald Trump speaks during a news conference at Mar-a-Lago in Palm Beach, Florida, Tuesday, January 7, 2025. (AP Photo/Evan Vucci)

The president’s lawyers called Ngoren’s ruling “draconian, illegal and unconstitutional.”

Trump’s lawyer, incoming Deputy Attorney General D. John Sauer, argued that James’ lawsuit stretched New York consumer protection laws and said lenders and insurance companies had “no victims” and “no File a complaint about Trump’s business.”

Click here to get the Fox News app

The reason “involves clear violations of the statute of limitations,” Sauer said, pointing to transactions used in nonjury civil fraud trials more than a decade ago.

Sauer said that if the verdict is not overturned, “people will not be able to do real estate business without fear.”