Why NBBO Economics has been distorted

We recently looked at how to trade in the market – usually starting with broker orders at Secaucus, traveling at fiber speeds to order orders in exchanges around the market, and then creating a reaction function at microwave speeds.

Today, we are looking at how quote updates usually flow in the market.

What we found is that the main list exchange sets new national best bids and quotes (NBBOs) in most cases. Then most venues see orders at a fairly consistent pace over time, but some venues have rapidly increased their offer for new NBBOs within the first millisecond.

This is an interesting question for the market structure and routers.

The listing places have the most NBBOS

We see who set up a new NBBO using the venue timestamp in all exchanges. This eliminates any delay in reporting new transactions.

We see that the major exchanges have set new NBBOs in most cases. This is not surprising, as the major exchanges also require competing companies to go public and companies compare based on reducing their capital costs (such as consistent quotes and things that differ in the gap).

For example, Nasdaq market makers list nearly 58% of stock quotes in Nasdaq-listed stocks. By comparison, all other exchanges have improved NBBO in NASDAQ stocks, less than 43% of the time.

Figure 1: More than half of the new NBBO price is set by the main list exchange

Other places have different speeds and speeds added to NBBO

What tends to happen more consistently is that other places join (or copy) major NBBO prices.

Importantly, we did not see all the venues rushing to copy NBBO quotes at light speed. Instead, as time (x-axis) progresses, most exchanges consider the arrival of new orders consistently.

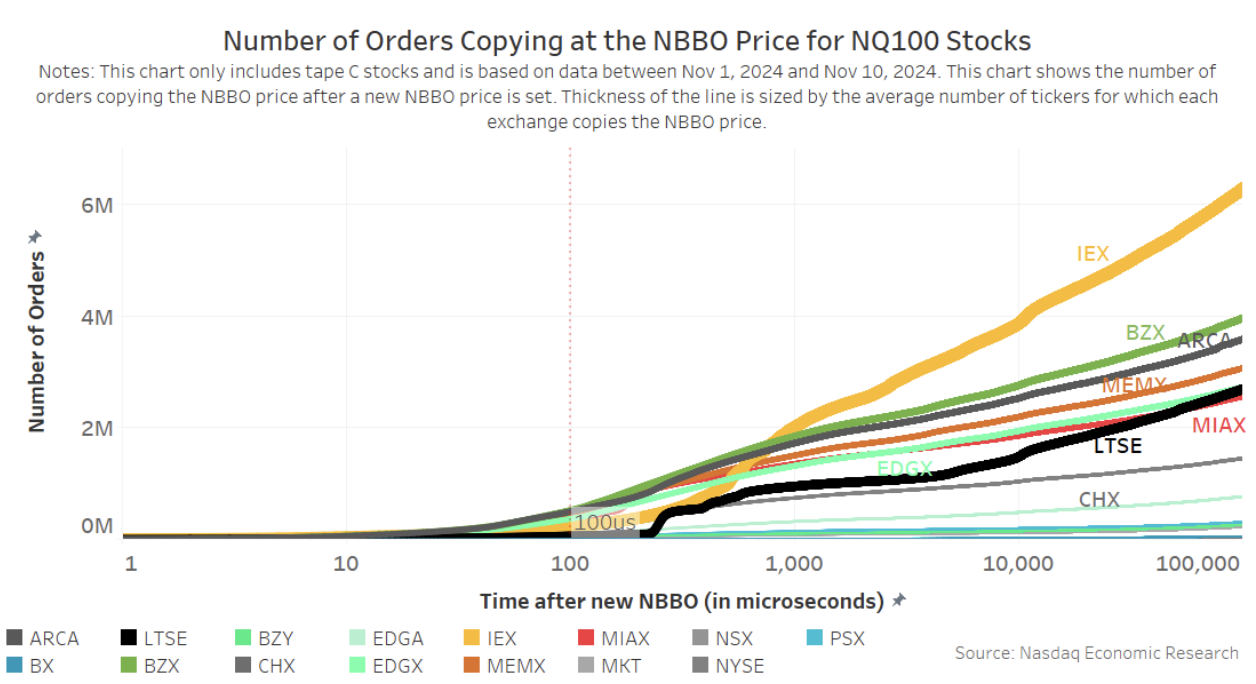

But there are some interesting exceptions:

- Jump sharply Shows a quick copy of new quotes. ltse and later IEX stood out, both of which were very good in 1 millisecond.

- The height of the line Shows that IEX stands out, especially for more liquid stocks in the Nasdaq-100 (Figure 2A), it has a quote that has more quotes than any other exchange to replicate NBBO, despite actually having a few exchanges actually On the market provides more liquidity (ARCA, EDGX and bat).

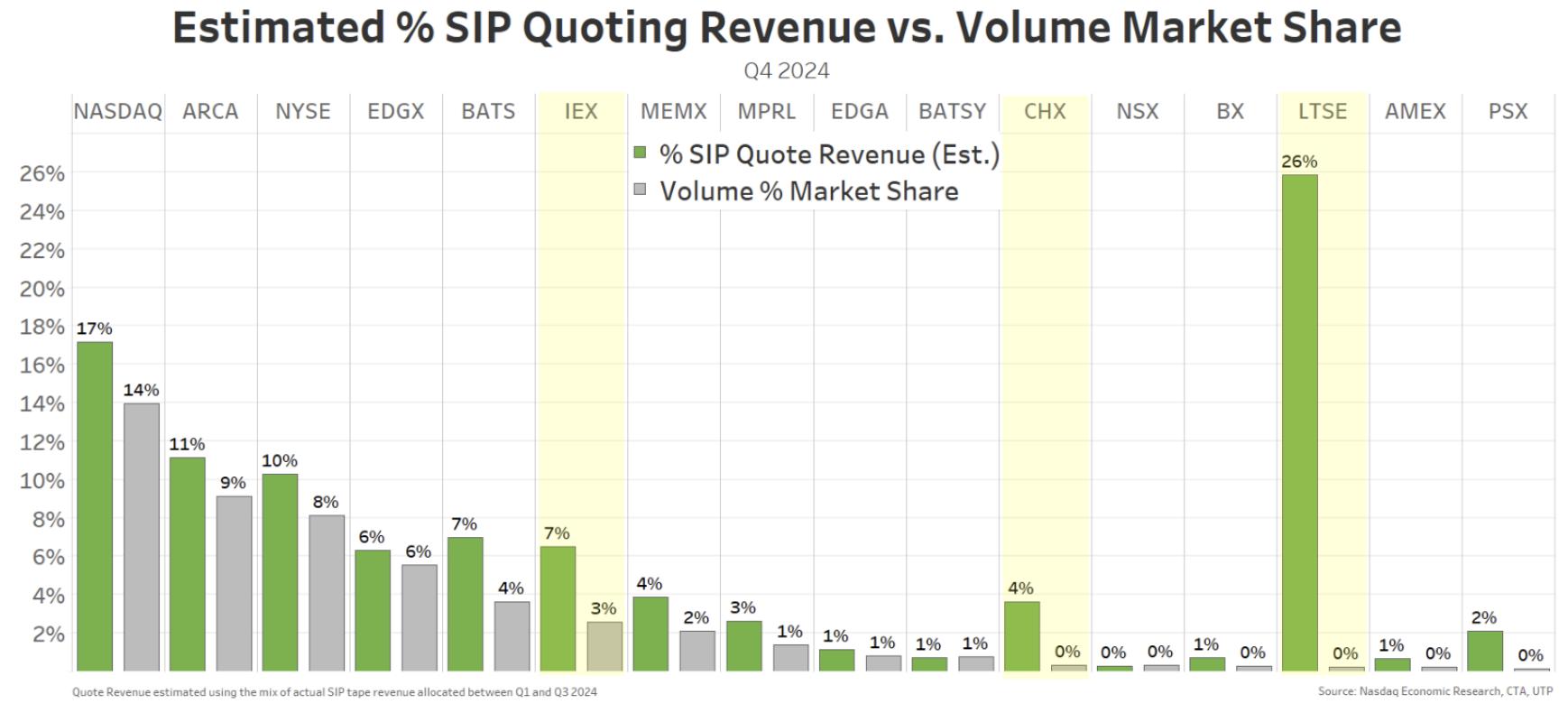

- Line thickness Shows the breadth of stocks in the universe where quotes are copied. IEX and LTSE stand out again, copying the quotes of more stocks, providing investors with extensive liquidity, especially compared to their trading market share (Figure 3).

Figure 2A: IEX Send Order Copy Liquid NBBO Quotation (NASDAQ-100) Stock

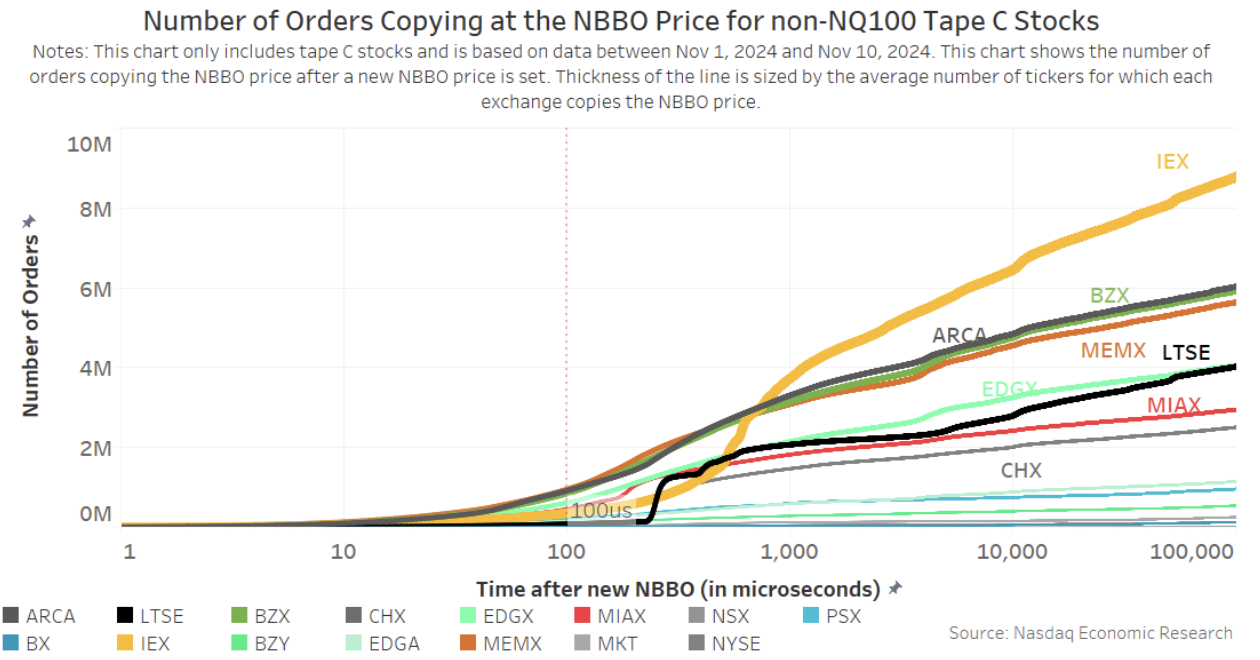

Interestingly, the pattern changes when we look at less liquid stocks. Given that there are about 3300 companies in the chart below (the increase in total quotes is relatively small compared to the 100 companies in the chart above. However, these lines start ordering how much transaction share or “actual” liquidity each exchange has.

Indeed, with fewer transactions, these quotes are not very profitable. But these are also stocks that require liquidity support. Even the SIP income distribution formula will tilt the quotes in these stocks.

Figure 2B: Replicating less liquid, smaller hats and stock quotes with less interest

Is this good or bad for the market structure?

This is important in different ways for different participants.

For brokers and traders, it reduces the exclusive need for speed to be at the top of the queue. That’s because, as long as you can find a venue with no orders at the venue, you can be at the top of their queue. This, in turn, helps improve traders’ profits and profitability for traders on these exchanges.

But the split adds other costs to brokers, including more connections and more complex routing. It also increases the cost of investors through higher opportunity costs.

There are other costs for diluting queue priority.

The system does not reward competitive quotes that lead to transactions

More importantly, the split of citations is not good for market makers to actually set up quotes in the first place. Their business is to profit from the spread capture, but the possibility of copying the offer is reduced.

Perhaps worse, the way data economics in the United States works has increased inefficiency. The SIP income distribution formula is designed to reward quotes and transactions “equally” regardless of who sets these prices more frequently. Back to the dozens of exchanges, some protected quotes were made using the speed bump, and it was set up to reward all quotes equally.

Looking at recent SIP revenues shows that some exchanges seem to earn a lot of quote income without actually doing any transactions. In some exchanges, communication costs such as discounts are obvious to reward marketers for providing these quotes, but in other cases, the cost of communication and benefits to municipal sellers is less transparent.

Figure 3: LTSE and IEX send orders that replicate NBBO quotes in large quantities

SIP quote revenue can increase exchanges by tens of millions of dollars. This is an artificial incentive that supports splitting without actually making the market competitive and cheaper to investors.

We need to make sure NBBO is good at protecting investors and issuers

Most of us seem to agree that NBBO is important to investors and issuers. Academic research also shows that tight spreads reduce capital costs and increase liquidity. This in turn helps make the U.S. market more attractive than many of the world’s markets.

We spend a lot of time arguing about the benefits of “public” and affordable NBBO. Perhaps we also need to make sure that economics can also fairly reward places and traders for these quotes. This can even help the market be more effective.