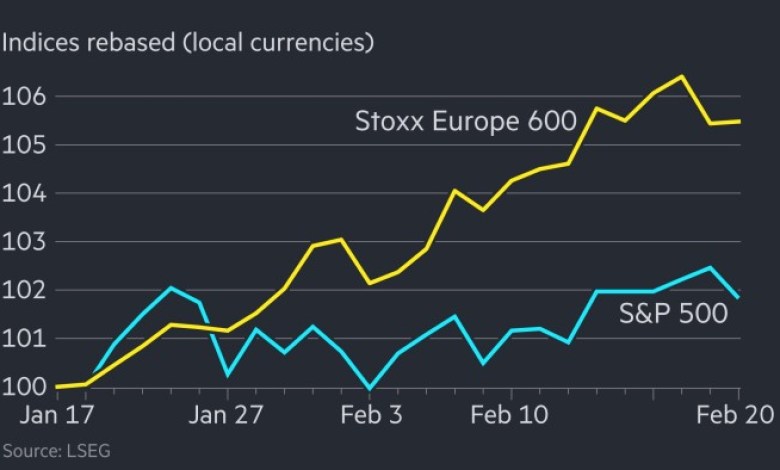

European stocks surpass Wall Street since Donald Trump took office

Free Unlock White House Watch News

Your guide on what the 2024 U.S. election means to Washington and the world

European stocks have surpassed the United States since President Donald Trump took office, hoping the region could escape the worst trade war.

The benchmark Stoxx Europe 600 has risen 5.3% since Trump re-entered the White House’s last trading day on January 17, while the S&P 500 has risen 1.6% on Wall Street, while the technology-heavy Nasda The gram composite material increased by 1.4. percentage.

Analysts say Trump’s decision not to impose tariffs on the EU and the prospect of peaceful negotiations in Ukraine.

The EU has become the main goal of Trump’s U.S. first policy, but it has not taken effect after the U.S. president promised a comprehensive tariff collection group.

“For Europe, the trade war bark is already worse than biting,” said Andrew Pease, chief investment strategist at Russell Investments. He added: “But other stories are bank loans over the past year,” he added. “The European Central Bank lowered interest rates.

Bank of America analysts said in a note Wednesday that the best start for European stocks was the best start since the late 1980s and had the strongest performance relative to the United States in nearly a decade.

After a long period of poor performance in Europe, U.S. earnings have been realized, as a huge rally in large tech stocks has boosted Wall Street in recent years. Trump’s election is the latest catalyst, with European stocks lagging behind the U.S. in expectations of a bruised trade war expectation.

Despite the stagnation of major economies in the mainland, Europe’s recent outstanding performance remains and concerns about the long-term security of the region as the United States threatens to retreat military support.

“At the beginning of the year, we were not overweight – [its strong performance] Daniel Morris, chief market strategist at BNP Paribas Asset Management.

European fund manager allocations have increased since the beginning of the year, and a survey this week showed that a proportion of the region said the region was underestimated for six years.

Sectors including finance, defense – the prospect of increased spending in Europe and the outlook for luxury stocks increased one-day tariffs.

Rheinmetall, the largest ammunition maker in Europe, has grown 31% in the past month, while luxury maker Richemont has increased 10%.

Meanwhile, the euro has risen 1.8% against the U.S. dollar in the past month.

UBS analysts distributed it to mainland Europe last week to increase their holdings, citing lower energy prices amid Russia’s invasion of Ukraine, loose fiscal policy and stronger corporate revenues.

Hong Kong has been the best performing main index since Trump’s inauguration, with the Hang Seng index rising 15% since January 20, led by the rallies of Chinese technology stocks listed on the territory following the DeepSeek Shock.

However, the CSI 300 in mainland China has only increased by 3%. The rest of Asia is flatter, with Broad Topix in Japan growing by 2%, and 50% dropping by 1% in India.

However, some analysts have expressed doubts about whether Europe’s performance can last for a year, especially if U.S. tariffs are only delayed rather than diluted.

Trump warned that imports from Europe could be the next one after the U.S. puts forward a 25% tariff on Canadian and Mexican imports and an additional 10% of Chinese goods.

Stock markets in the region fell Wednesday as the U.S. president said he was considering a 25% tariff on auto, pharmaceutical and chip imports. On Thursday, the Stoxx 500 fell 0.1%.

“For most investors, muscle memory is that Europe can only perform in a small amount in a very short time,” UBS analysts said.

Other reports by Ray Douglas