Intel stock back to where it was 27 years ago: How the world’s leading chipmaker failed three times – Intel (NASDAQ: INTC ), Advanced Micro Devices (NASDAQ: AMD )

Intel Corporation international trade center The stock has had a rough 2024 so far, down more than 56% year to date.

What’s the reason? The world’s leading chipmakers have fallen behind the curve, ceding the market to companies such as AMD AMD, NVIDIA Corporation NVDA Didn’t even catch up Qualcomm Qualcomm In terms of smartphones.

The world’s leading chipmaker has lost control of both established and emerging technologies – it no longer dominates the x86 space, and companies like Nvidia have completely dominated the AI chip space.

See also: Nvidia’s AI dominance pits Intel, AMD in battle for second place

Intel’s failure to innovate is also reflected in its stock price – at $20.92, it’s roughly back to where it was nearly 27 years ago.

Even worse for the blue team is Intel (its rival AMD is the red team), whose market value has shrunk enough to spark rumors that rivals like Qualcomm are interested in acquiring it. Qualcomm’s interest in acquiring Intel reportedly subsequently waned due to the “complexities” involved in the deal.

See also: Palantir co-founder Joe Lonsdale cheers Trump’s new SEC pick, calls out Gary Gensler for “deliberately” not defining cryptocurrency rules

For context, Intel has a market cap of $90.22 billion, while Qualcomm has a market cap of $177.26 billion.

Intel’s closest competitor, AMD, is valued at more than twice that, at $224.91 billion.

On the other hand, Nvidia’s market value is relatively high, reaching $3.488 trillion, which is more than 38 times Intel’s market value.

Things got so bad at Intel that the chipmaker gave up Pat Kissingeran industry and Intel veteran, in a less than ideal way.

Lack of innovation, manufacturing difficulties, and intensified competition

While Intel’s troubles have been going on for several years, problems with its latest desktop chips may have been the straw that broke the camel’s back.

After several reports revealed problems with Intel’s 13th- and 14th-generation chips, the company became aware of the issue, but ultimately gave up on fixing them through software updates.

The result? Gelsinger had to leave before completing his mission on the 18A manufacturing process – although the company says it has started, wafers made using the process have not yet been released.

See also: MicroStrategy’s Michael Saylor risks destroying ‘magic money creation machine’ by increasing bets on Bitcoin, experts say

Gelsinger and Intel had hoped 18A would be a success, especially to keep its struggling foundry business alive.

However, with Gelsinger now gone and no suitor in sight, Intel’s future appears to be up in the air.

Price Action: Intel shares closed at $20.92 on Friday, up 0.6% on the day. Year to date, it has fallen 56.2%.

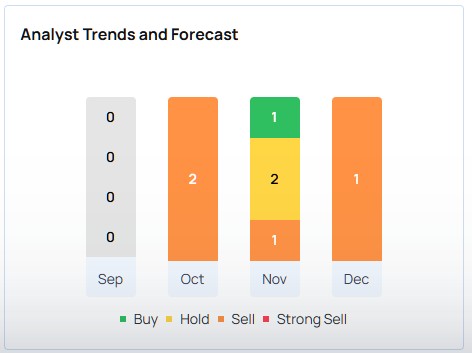

Analyst consensus rating on Intel stock is “neutral,” according to Benzinga Pro. Bank of America Securities, Northland Capital Marketand Mizuho is one of three latest analyst ratings, and their average price target is $24, implying an upside of 14.7%.

But can Intel reverse its fortunes? Only time will tell.

See more from Benzinga’s Consumer Technology Report follow this link.

Read next:

Disclaimer: This content is generated in part with the help of artificial intelligence tools, and is reviewed and published by Benzinga editors.

Photo credit: Unsplash

Market news and data brought to you by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. all rights reserved.