6 retirement statistics, which will make you think twice before thinking about the future

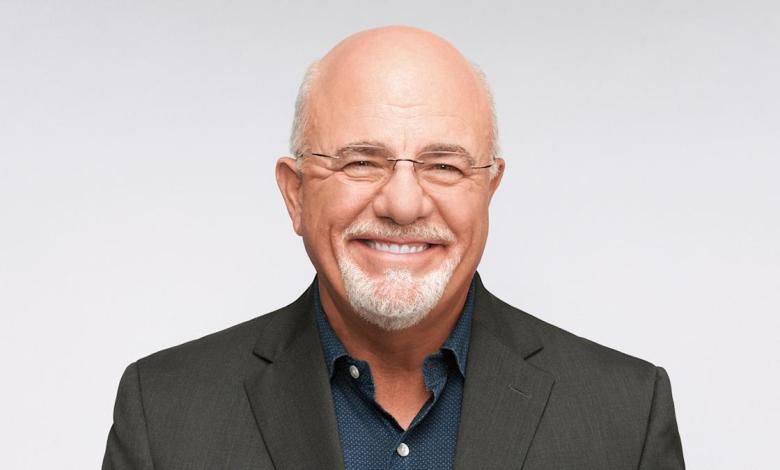

Whether your monthly bill has little left over cash or you want to focus on other goals, you may find yourself needing to catch up with many Americans who are saving for retirement. If you are far from retirement age, you may not have the pressure to contribute too much. But these six retirement statistics, shared by finance guru Dave Ramsey on his blog, may make you think twice.

Beware: Avoid retirement saving mistakes for Americans who lose up to $300,000

Read next article: 5 clever geniuses that make all rich people make money with their own money

Ramsey explained that 54% of American workers don’t even know their retirement savings needs. This makes it very challenging to track your progress on a regular basis.

Many factors play a role in your savings needs, including your retirement age, expected lifestyle, cost of living, inflation, income sources, and health care costs. You can use an online calculator, such as AARP’s calculator, or you can talk to a retirement consultant to find out.

Learn more: If you retire in 2025, you need to consider 5 cities

If you want a monthly social security payment life, you might be surprised that the average monthly payment in January 2024 is only $1,907. The Social Security Bureau also mentioned that these payments cover only 40% of the payments you earn while working.

Since this may not cover your expenses, getting enough retirement savings is crucial to your financial security. Also, don’t forget about potential changes in Social Security that may negatively affect your welfare amount.

Ramsey Solutions’ 2023 report shows that 34% of people don’t save any money at all. This includes not only pensions, but also savings for contingency funds and other targets. Apart from creating an economic struggle during retirement, it is dangerous to have no savings to deal with today’s emergency situations and can lead to debt.

Put monthly income into practice regularly and provide financial security. You might set some initial goal of spending at least three months on emergency situations, with 15% of your income.

Ramsey mentioned that 39% of Americans do not invest in stocks, which tend to get the best average return in their investments. Some investors may be dissatisfied with the higher volatility brought by these investments and instead choose safer, less profitable options.