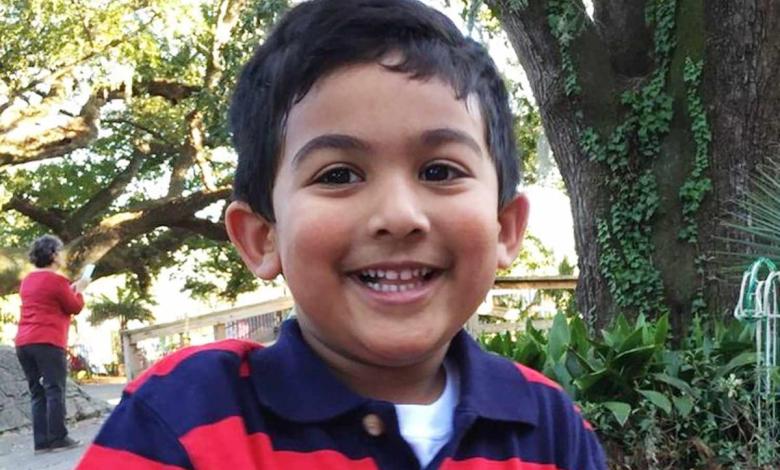

Abdul Aziz Khan disappeared from Georgia 7 years ago and found out in Colorado why his mother is facing charges now

A boy was discovered who was kidnapped by Georgia seven years ago.

Douglas County Sheriff’s Office announced Wednesday, March 5 that Abdul Aziz Khan, 14, was found in Colorado.

Deputies were called to a home on Kellywood Road, Highland Ranch, Colorado to investigate the burglary around 3:37 p.m. on February 23, according to the Sheriff’s Office.

“Homeowners monitored the security cameras of their homes for sale, noticed some suspicious activity and immediately called the Sheriff’s Office,” Douglas County Sheriff Darren Weekly said in a news conference Wednesday.

Deputies arrived soon and met two children in a car in the driveway.

Douglas County Sheriff

Rabia Khalid

Not long after, a man and male were later identified as Abdul’s mother, Rabia Khalid and Elliot Blake Bourgeois, who claimed they were “related to real estate agents,” according to a press release from the Douglas County Sheriff’s Office.

The weekly said delegates “started to reveal the contradictions in the suspect’s story.”

He said the deputies said, “Terrently working to verify everyone’s identity. They knew something was wrong. They were following the gut and investigating further. They just didn’t base on the face value and went on with a simple way out and kept going. They dug and dug for about five hours until they figured out what was going on.”

Douglas County Sheriff

Elliot Black Bourgeoisie

Related: Missing mom finds dead after her birthday in North Carolina, family claims her boyfriend stays there alone

Deputies finally discovered that the boy was kidnapped in Atlanta on November 27, 2017, and Khalid, 40, was wanted. It seems that once a week Khalid allegedly tied Abdul to Abdul, “it seems like the father will be fully custody of the child.”

Khalid faces several charges, including kidnapping, forgery, identity theft and intrusion. The 42-year-old bourgeoisie faces 14 charges, including kidnapping, forgery, identity theft, providing false information to authorities, and intrusion.

Both children were taken to protective detention.

Authorities will not comment on the identity of the second child.

Want to keep up with the latest crime reports? Sign people for free crime news, ongoing trial reports and attracting details of unresolved cases to sign people for free crime newsletter.

Related: 14-year-old boy was found “physical” while he was snowmobiling in remote areas of Idaho

“We are overwhelmed,” Abdul’s family said in a statement released by the National Center for Missing and Exploited Children. “We want to thank everyone for their support over the past seven years. Now, as we browse the next step, we ask for privacy so that we can move forward as a family and recover together.”

Read original articles about people